|

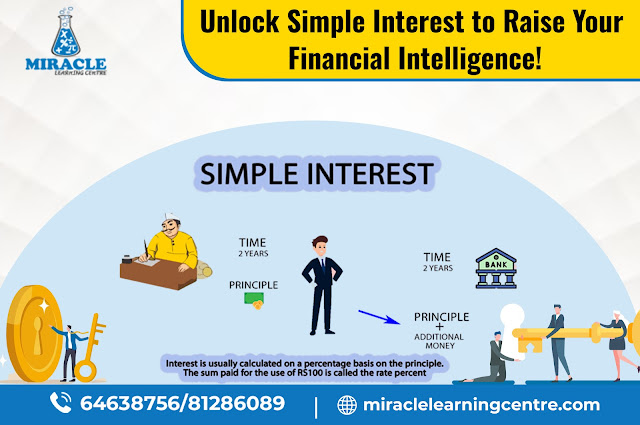

In the vast world of mathematics, it's often the simplest concepts that serve as the foundation for more complex calculations and financial decisions. One such fundamental concept is simple interest. Whether you're a student looking to grasp this concept or an individual eager to enhance your financial literacy, mastering simple interest is crucial. Fortunately, Miracle Learning Centre, renowned for its exceptional maths tuition programs, can be your guide on this journey toward understanding the power of simple interest.

What is Simple Interest?

Simple interest (SI) is a calculation of the interest on a loan or investment that is based on the principal amount, the interest rate, and the time period. It is calculated using the following formula:

Simple Interest = Principal Amount × Interest Rate × Time Period

Simple interest is a straightforward and easy-to-understand concept, but it is important to note that it does not compound. This means that the interest earned in one year is not added to the principal amount to calculate the interest for the following year.

Formula:

Simple Interest (SI) = Principal (P) * Interest Rate (R) * Time (T)

Where:

P is the Principal Amount

R is the Interest Rate (in decimal)

T is the Time Period (in years)

Example:

Let's say you borrow $1000 from a bank at an interest rate of 5% per annum for a period of 2 years. The simple interest for this loan would be calculated as follows:

Simple Interest = $1000 × 0.05 × 2 = $100

This means that you would have to pay back $1100 to the bank at the end of the 2-year period.

Applications of Simple Interest

Simple interest is used in a variety of financial transactions, including:

Loans: Simple interest is often used to calculate the interest on personal loans, car loans, and student loans.

Investments: Simple interest is also used to calculate the interest on savings accounts and certificates of deposit (CDs).

Credit cards: Simple interest is used to calculate the interest on credit card balances that are not paid in full each month.

Advantages and Disadvantages of Simple Interest

Advantages:

Simple interest is easy to calculate and understand.

It is a transparent and fair way to calculate interest.

It is often used for short-term loans and investments.

Disadvantages:

Simple interest does not compound, which means that you can earn more interest on your money over time by investing in products that offer compound interest.

Simple interest is often lower than compound interest, so it may not be the best option for long-term investments.

Miracle Learning Centre for Maths Tuition

Miracle Learning Centre is a leading provider of best maths tuition in Singapore. They offer a variety of courses to suit all levels of students, from primary school to Junior College. Their experienced and qualified math tutors can help you to master even the most challenging concepts. For anyone facing difficulties with subjects such as simple interest or any other mathematical topic, reaching out to Miracle Learning Centre is strongly recommended.

Conclusion

Simple interest is a fundamental concept in mathematics and finance. It is used in a variety of financial transactions, including loans, investments, and credit cards. While simple interest does not compound, it is a transparent and fair way to calculate interest.

For individuals experiencing difficulties with topics such as simple interest or any other mathematical subject, Miracle Learning Centre encourages them to reach out for assistance. They provide a range of mathematics tuition courses tailored to accommodate students of all levels.